Top 10 Bank To Open A Bank Account With No Deposit Required 2023

Opening a bank account is a must-have element to move forward in this developing world, as most platforms have started refusing money from consumers directly. It is pretty simple and straightforward if you are trying to open a bank account with no deposit. But what if you have bad credit or adverse banking history that restricts you from opening a bank account?

In such circumstances, you may try to open a bank account with no security deposit. However, several banks are willing to work with you as a helping hand.

A checking account is a necessary part of your financial life since it helps us stay forward without any risks or obstacles. But you may also have to invest a decent amount of money in opening a checking account.

Most banks require depositing a minimum amount of money to open, activate, and function a checking bank account. Paying that minimum deposit can be challenging if you don’t have a well-furnished financial status. We’re here with a listing of providers that open a bank account with no deposit required (requires few to no minimum deposition).

Top 10 Bank To Open A Bank Account With No Deposit Required 2023

Most people stay frustrated when shopping because they don’t have a checking account due to reasonably furbished credit. We have discussed banks (primarily online) offering checking accounts with no deposits and hassles.

Moreover, most of these banks provide easy accessibility and well-competitive interest rates. After reading this content, you can comprehend a clear conception of these banks/providers thoroughly.

Let’s move forward with the explanatory discussion!

1. Axos Bank

Axos Bank is one of the most prominent full-service online banks in the United States, which is a federally chartered bank.

It comes with an easy banking and loan giveaways system that requires little to no charges for a direct banking system.

Axos bank’s headquarters is located in San Diego, California, and it is a primary consumer brand of the brand Axos financial.

You can rest assured that you can open a bank account with no deposit required from Axos Bank. They have a category with five different account types for checking bank accounts.

The types are – First Checking, Rewards Checking, CashBack Checking, Golden Checking, and Essential Checking. The Essential Checking Accounts of Axos bank are one of the best in terms of convenience.

Essential Checking accounts are no-frills accounts that require no monthly fees and initial deposits. The other account types come with slightly increased benefits and require a minimal deposit and yearly APY (Annual Percentage Yields). Rewards Checking and Golden Checking accounts require a minimum of 50-dollar deposits for account activation.

Features Of Axos Bank Essential Checking:

The Essential Checking account from Axos Bank has numerous benefits you can count on. We are discussing the Essential Checking account type since it is a no-deposit account.

- Essential checking requires no activating fees and Early direct deposit.

- You can get unrestricted domestic ATM fee reimbursement.

- Moreover, you don’t need to pay extra monthly account continuation and maintenance charges.

- Allows opening bank accounts with no minimum monthly balance requirements.

- Requires no overdraft or non-sufficient fund charges.

- You can earn up to 0.61% APY, making money faster and saving more.

Benefits of Axos Bank

Axos Bank has peer-to-peer payments that allow you to pay your friends directly from your account and just need an email or mobile number.

- With account alerts, you can stay up to date about your activities and push notifications.

- You can activate, deactivate or reactivate your debit card through the Debit Card Management feature.

- It has a biometric authentication process that requires fingerprints, voiceprints, and facial recognition for optimal security.

- Automatically pay your bills with the Bill Pay feature.

- Others- two-step authentication, antivirus, and malware protection, automatic logout, SSL encryption, account monitoring, etc.

With your valid ID card and Social Security Number, you can apply to Axos Bank Essential Checking accounts within 15 minutes.

2. Ally

Ally is an online-based bank that allows opening bank accounts with no security deposit required. It is one of the most reliable and handy banks that pay more Annual Percentage Yields for the credits.

One of the most highlighted points that makes Ally so loyal is their effortless account setup and high-marked customer service.

With Ally credit check banking, you can safely save more and grow your marks faster. Opening a checking account at Ally is so straightforward that it will take just about 5 minutes to activate the services.

All you need is your Social Security or Tax Identification Number and a legal US residential street address. However, you need to be 18 years old or older to open a bank account.

Always provide your date of birth and a legal name during activation. With Ally Interest Checking Account, you can easily count your daily banking.

They provide APY for accounts that have a minimum 15000 dollars balance. It is a certified account meeting the National Account Standards, providing safe, low-cost, low-fee account access.

Features Of Ally Interest Checking Account:

Ally claims they provide banking benefits like no other banks. Ally bank’s Interest Checking Account will work as a financial helping hand in your everyday life. Let’s see what the features of their Interest Checking Account are!

- Provides comfort, flexibility, and security for your checking account.

- You can open your checking account using the name of a trust.

- Requires no minimum balance for account activation.

- It is FDIC-approved, which means the Federal Deposit Insurance Corporation insures your money.

- They don’t charge any monthly fees for account maintenance.

- Gives 0.10% APY for accounts with less than 15,000 dollars minimum daily balance, and 0.25% for 15,000 dollars minimum daily balance.

- Define how, when, and where your Ally Bank debit card is used through Debit card controls.

- Has more than 43,000 no-fee Allpoint ATMs across the US.

Benefits of Ally Bank:

Ally Bank has a quick response rate for customer satisfaction, and their customer center waiting period is just 1 minute.

- Ally Bank has an eCheck Deposit feature that allows you to deposit your check remotely.

- You can quickly check your money growth with included interest compounds regularly.

- With their dedicated service Zelle, you can send and receive money to people without any maintenance or service fees.

- They have Round-Ups service that saves more when you spend with it.

- Ally Bank charges just 7.50 dollars returned deposit items and 15 dollars for expedited delivery.

- For outgoing domestic wires, they charge 20 dollars.

- With just 25 dollars per hour, you can research your account.

- Requires no low daily balance fee, overdraft item fees, Postage-paid deposit envelopes, online statements copies, Standard or expedited ACH transfers.

You can open interest checking accounts within a few minutes from Ally Bank. First, you should tell a bit of yourself by providing personal details.

After that, you should fund your account and enjoy the award winning baking services from Ally. Account finding or depositing is not mandatory, but you can earn interest as soon as you fund money.

3. Betterment

The Betterment checking account is a mobile-based online banking system that provides access to both actual accounts and Visa debit cards through mobile phones.

Their checking accounts and the Visa Debit Card are provided and issued by NBKC bank, an FDIC-insured bank.

If you desire to open a bank account with no deposit required, you can check Betterment Banking. They offer hassle-free checking accounts that don’t require fee checking or deposits.

You should note that Betterment is not a bank. It is an online or mobile-based banking system.

Since the Betterment checking accounts are FDIC insured, observed by NBKC bank, you can save up to 250K dollars through each account. When you spend more with Betterment credit cards or mobile accounts, you can get cash back from 3% to 5% on various approved shops.

Features of Betterment Checking Accounts:

Betterment was launched with the motto of helping users who are struggling to open a bank account due to financial instability.

- It requires no fees for ATM and foreign transactions.

- All their usage fees are automatically reimbursed, and they charge no overdraft fees.

- Your account will be safe and secured as it is incorporated with FDIC, and you can insure up to 250K dollars through NBKC bank.

- It allows you to change your PIN and password and lock your card simply from your mobile app.

- Pay on the go since they support tap-to-pay Visa debit cards, mobile options like Apple Pay and Google Pay, or paper checks.

- You can earn up to 3-5% cashback benefits on purchases in favorite shops like Adidas, Dunkin, Walmart, etc.

- If you pay your cell phone bill with a Betterment Visa Debit card, you can get cell phones no credit check no deposit.

They also allow joining checking accounts which allow sharing benefits to all your partners by keeping one Visa credit card for large purchase.

Applying to Betterment Checking accounts is super simple, and you can perform it in minutes. All you need is your valid personal address, email/phone number, social security number, and a few minutes.

4. Capital One

Capital One is one of the United States’ trusted banks that offers many account categories, including checking accounts. They allow opening a bank account with no security deposit required.

Capital One 360 checking account is one of them that requires the no to minimum security deposit fees for opening a checking account.

It is a physical bank that also offers 24/7 mobile banking that you can access with your Capital One mobile app.

You can open, keep, and use checking accounts without paying any fees to save money in the long run.

Capital One also has more than 70000 fee-free ATM locations/shops that you can use for any utilities.

With the Capital One 360 checking account, you can use it safely and securely even if you lose your debit card. Even after losing your debit card, you can simply lock and unlock it from the dedicated mobile app of Capital One.

With Zelle, you can transfer money to people without maintenance or service fees. Capital One offers more benefits and handy features; let’s explore them!

Features Of Capital One 360 Checking Account:

This checking account requires no credit check and no security deposit. You can access numerous privileges at your fingertips through their top-rated mobile app.

- With their FDIC-insured checking accounts, including Fraud coverages, you can bank securely.

- From any CVS store location, you can add cash to your checking account.

- With Zelle, you can make online transactions on the go without any maintenance or service fees.

- They offer in-person assistance with their friendly Ambassadors at their branches or cafes.

- You can access your money two days before your payday with the Early Payback service.

- They have a wide range of overdraft options that allows you to spend more without worries.

With protected account access through mobile apps, you can also Deposit checks without waiting in long lines like others. They have a virtual assistant(Eno), which provides you with more safety by giving real-time alerts about your checking account. Unlike any bank that opens your checking account first, you can open it first by yourself on a mobile phone from Capital One.

5. Chime

Chime is a mobile banking service that offers fee-free banking features owned by the Bancorp Bank or Central National Bank. Founded in 2013, it is located in San Francisco, California.

It offers satisfactory customer service with more than 60 thousand ATMs across the United States. You can make Free Visa Debit card which can be operated effortlessly by their dedicated mobile app.

It means you can control the overall things of the account or the Visa Debit card through your mobile. You should note that Chime is not a bank; it is a tech company offering mobile banking benefits.

You can trust the services of Chime if you are looking to open a bank account with no deposit required. Chime has serious security checking control procedure covered with 24/7 customer support.

They have three categories of accounts under their mobile banking service. They are – Spending Accounts, Credit Builders, and Savings Accounts.

With Chime, you can build your credit history and enhance your credit scores with no annual fees or interest. They pay up to 2 days before your payday with the direct deposit, so stay assured.

Features of Chime Mobile Banking:

Among the numerous benefits Chime provides, the most striking one is that they don’t charge any monthly fees for usage. Let’s discuss the features or benefits of Chime mobile banking!

- They charge no monthly fees for account usage.

- You don’t need to pay any overdraft fees or the security deposits.

- Chime offers free foreign transactions with more than 60 thousand fee-free ATMs around the USA.

- Their Credit Builder secured credit card can help you build up to 30 credit points on average.

- Pay to anyone anytime without any extra fees, just with a simple mobile app.

- They offer up to 0.50% Annual Percentage Yields on the deposited money so that you can grow your money faster.

- With automatic Balance and Transaction alerts, you can always stay controlled with your account.

- Through direct deposits, Chime provides a paycheck two days earlier than most of your teammates.

- With SpotMe service, Chime spots up to 200 dollars on debit card purchases without any overdraft fees

Opening an account with Chime is pretty simple and Straightforward, and you can perform in minutes. You can access your Chime credit card-based mobile banking on the run, anytime, anywhere!

Since Chime is FDIC-approved, you can insure up to 250 thousand dollars through the Bancorp Bank or the Stride Bank. Chime has 24/7 award-winning and satisfactory customer support, and you can reach them by phone, email, in the app, or check out the Support Center.

6. Discover

Discover is one of the popular mobile banking services which offers convenient banking through mobile apps.

It doesn’t matter which online bank you choose; they will keep the terms simple and give you greater rewards. The services of Discover Mobile Banking are stellar and pleasing.

You can choose Discover mobile banking if you want to open a bank account with no security deposit.

Discover also has more than 60 thousand no-fee ATM booths around the United States, so you can access one from your local area. Opening a bank account with Discover mobile banking is pretty straightforward, and you can do it in 5 minutes.

They maintain a friendly 24/7 customer service available to get you back in any need, anywhere! If you want to open a bank account with Discover mobile banking, you need to give just a few primary data. For example, you may require to provide your name, address, social security number, or Email account.

You can deposit money while opening the account or do it later whenever you want. After a few minutes of submitting the application form, they will send you a confirmation email, and now you’re ready to move on! Since the content is about opening a bank account with no deposit required, we’ll now discuss the facts about Discover Checking Accounts.

Features of Discover Checking Account:

Discover checking mobile accounts come with debit card benefits for every purchase, and their cashback is not just for credit cards.

Cashback Debit is an online checking account with a debit card that allows you to earn cashback for your spending.

- You can get up to $3000 cashback monthly on your orders and purchases.

- With their cashback Debit Card account, you don’t need to pay any operating fees.

- They also don’t charge for maintenance, debit card replacement, ATM withdrawal, online bill pay, or official bank check.

- They won’t charge you anything if you stop the payment order or have insufficient funds.

- Their service Zelle offers fee-free send money, pay bills, and much more through your mobile.

- You can freeze your debit card if your card is lost or misplaced.

- Gives access to more than 60,000 ATM stores and authorized locations for fee-free withdrawals and payments.

- An encrypted and secured platform offers optimal protection to your account or Debit card.

Discover Mobile Baking Debit cards provide up to 1% cash back on every purchase. Suppose your monthly deposit remains about 1250 dollars; here, you can get up to $12.50 cashback.

Thus, you can get up to 150 dollars every year, which is pretty much overwhelming. If you want to comprehend more about Discover Mobile Banking, check the FAQ section.

7. State Farm

State Farm is an online mobile banking service operated by the US Bank. You can now open an online account with a US bank simply by your local State Farm agent.

With the dedicated mobile app from State Farm, you can now use your account 24/7 from anywhere. Moreover, you can enjoy interest in your Cash Deposits on the savings accounts of State Farm.

State Farm by US Bank comes with four different account opening alternatives. They are – Easy Checking, Gold Checking Package, Platinum Checking Package, and Safe Debit Account.

With State Farm mobile banking, you can access your money at thousands of U.S. Bank branches and ATMs in 25 states.

US Bank has one of the most expansive ATM networks in the United States, with more than thousands of ATM locations. The Easy Checking Account provides the most benefits at fewer expenses among their checking accounts. Therefore, now we’ll cover up the overall features and benefits of State Farm Easy Checking Accounts.

Features of State Farm Easy Checking Account:

Easy Checking is a basic checking account with special features offered by the US Bank, just for State Farm users.

You can get these benefits if you apply to the US Bank Easy Checking account through the State Farm service.

- For the first 12 months, you can make transactions and use the account with 0 dollars maintenance fee.

- They don’t charge any fees for the first Non-U.S. Bank ATM Transactions in each statement period.

- You can get the initial logo checkbox from the US Bank free of cost.

- Get up to 50 percent off on check reorders.

- Offers up to 50% discount on an initial box of unique check designs.

- Charges no fees for overdraft protection transfers made from a linked US Bank deposit account.

After one year of no-fee account usage, it will charge up to 6.95 dollars monthly for transaction or maintenance fees. However, you can waive this small monthly maintenance fee in several ways.

You can waive this fee if you have a total of 1000 dollars direct deposit on your account. Otherwise, if you keep an average account balance of up to 1500 dollars and are aged 65 or more, you can use the account for free!

8. First National Bank

First National Bank is a physical bank that comes with a mobile banking alternative with more flexibility and benefits. You can check out First National Banks’ Mobile Banking if you aim to open a checking account online instantly no deposit is required.

They offer 24/7 customer support with sheer protection to your account with a secured platform.

With the First National Bank FreeStyle Checking Account, you can access everything you need to lead your financial lifestyle.

You can use it as a debit card, do online banking from mobile, make online statements and pay bills on the go.

With all that, this account is free from hassling things like minimal deposits or maintenance fees.

With the FreeStyle Checking Account from First national bank, you can save up to hundreds of dollars when you spend money from it. This is a Freestyle checking account, so you can write unlimited checks without restrictions. With all their physical accounts, you can also enjoy digital benefits like Mobile Banking, Online Baking, and Digital Payments.

Features of First National Bank FreeStyle Checking Account:

First National Bank has five different account types. Amongst all, the FreeStyle Checking account offers baking benefits at low to no costs.

However, before you proceed to any accounts, you can compare checking account benefits to determine which one suits best for you.

- Offers unlimited check writing without any extra costs.

- You don’t have to pay any fees for account opening and activation.

- Without any monthly service charges or maintenance fees, you can use it.

- Free Visa debit card with free Apple Pay, Samsung Pay, or Google Pay cards.

- You can withdraw money and make payments free of cost with more than 850 First National Bank ATMs around the US.

- Gives access to the Fast and free Online Banking, Mobile Banking, and Telephone Banking of First National Bank.

- Fee-free cash deposits anytime, anywhere at FNB branches, ATMs, or through Mobile Banking.

To apply to FNB Freestyle Checking Account, you must visit the FreeStyle Checking page, select the product, add it to the cart, and checkout. Before you apply, you should comprehend that you need to initially deposit 50 dollars for online orders and 0 dollars for orders at physical branches. The first national bank provides a second chance credit card with no security deposit.

You also need to keep ready these identifications- A non-expired ID (driver’s license, state-issued ID, Military ID, passport, or Permanent Resident Card and visa). You can add a Penguins Power Play card during checkout to avail yourself of more long-term benefits.

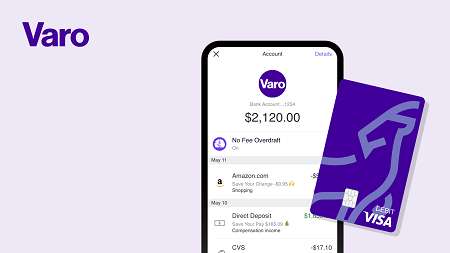

9. Varo Money

Varo is a full-service online banking platform that comes with banking facilities controlled by mobile apps. You get an online bank account with no monthly fees or minimum balance with Varo.

Varo Money offers to open a bank account with no deposit required, which means you can open a bank account free of cost.

Varo Money now offers to send money or receive money from any Varo to Varo bank account free of cost. Since it is a mobile app-based banking service, you don’t have to wait for the transactions.

Varo bank gives Visa Debit cards which you can use to pay instantly wherever the Varo logo is visible. You can lock your EMV-chip debit card in the Varo Bank Mobile app within a few seconds.

All Varo Visa Debit cards come with Zero Liability fees which means you don’t have to pay anything for any unauthorized charges. You can sign up for a Varo Money account within a few moments, and the process starts by processing your email.

After that, you must provide your legal US address and phone number. Lastly, you must give an 8-digit password two times and apply.

Features of Varo Money Checking Account:

One of the key plus points of a Varo money mobile bank account is you don’t need to enter a branch when your account is online. Here are the benefits you can access after opening an account with Varo Money.

- They will provide you with a debit card that you can use anywhere VISA is accepted.

- With their direct deposits service, you can get paid up to days earlier before your payday.

- If your card gets lost or misplaced, you can lock your card with your phone within seconds.

- You can access and manage your account’s tasks whenever you want with your Android or iOS device.

- They don’t charge monthly account fees, transfer fees, or foreign transaction fees.

- Make transactions with more than 55 thousand ATM checkpoints around the country nearby your locality.

Varo Money Banking is also an FDIC member, which offers you insuring up to 250000 dollars under the FDIC deposits. You can also connect all your other financial accounts to manage your money and perform transactions from one convenient app.

You can access all your deposit checks through the app once you have received your first direct deposit. Using the Green Dot Reload, you can deposit money to more than 90 thousand retail locations. So let’s open an account with Varo Money today and start rebuilding your credits.

10. Navy Federal

This one is a specialized banking system for active or retired members of the military, navy, and other government employees. Navy Federal is mainly a credit union that provides daily checking accounts with no minimum deposit, and they also don’t require any minimum balance for account activation.

Navy Federal Credit Union can be excellent for you if you are a federal member and desire to open a bank account with no deposit required.

Suppose you are one who always has a lower account balance or an unfurnished credit score.

In that case, you can open a Navy Federal account which offers a flexible standard account for everyday use. Navy federal Checking Accounts provide effortless and free everyday checking.

To reduce paper waste while increasing your account security, you can switch to Navy Federal Paperless Statements through mobile banking accounts.

Features of Navy Federal Checking account

- With their direct deposit, you can make transactions safely and conveniently.

- The Navy Federal Debit cards provide zero liability protection, and you can make payments worldwide where a Visa card is accepted.

- It charges just 0.01 percent dividend rates and pays up to 0.01 percent Annual percentage Yields.

- You can pay your bills automatically and monitor the sectors where you’re spending.

- With their dedicated service Zelle, you can manage all the transactions online and track your activities through automatic notifications.

- Order online quickly with Free traditional name-only checks offered by Navy federal Everyday Checking account

- Charges no monthly fees, no maintenance fees, no account opening balance requirements, and no minimum deposit

- They have checking protection options that will make your account usage protected & safe.

How To Pick The Best Bank For Checking Accounts

Most people tend to pick banks regarding their convenience and the location of the bank nearby their residence. But that fact will not work anymore, as you must also comprehend other factors before choosing a bank account for your everyday essential checking.

Fees

By charging fees from consumers in specific sectors, the banks make a profit. A few standard fees that banks charge are ATM charges, foreign transactions cost, minimum deposits, minimum balance, overdraft fees, etc.

If you find a bank that charges these fees, you don’t need to ditch this bank immediately. You should check profoundly and do thorough research to find ways where you can waive these fees from certain banks.

Interest Rates

Banks usually offer interest rates on the account balance or the deposited amount of the account to retain consumers. Before you choose a bank, you should consider the interest rates or the APY rates that the bank provides. However, the interest percentages can fluctuate anytime as the Federal Reserves control them.

Other Privileges

Are you happy with brick-and-mortar banks, or do you prefer online banking systems? Does your preferred bank have thousands of ATM locations to provide convenient transactions everywhere?

Are there any security or protection features available in your bank? Comprehend these facts and pick the best one according to your needs.

Final Verdict

So, now you know some banks are willing to work with you even if you have lousy banking history or poor credit. But most of the banks that open a bank account with no deposit required are online banks & the online segment of physical banks.

Read the bottom section before making the ultimate decision that best suits your financial goals and requirements.