10 Best 24 Month Interest Free Credit Card Providers 2023

We’re always up for value. We want good deals, freebies, and the best rates especially when it comes to credit cards. What would you say if you were to use a 24 month interest-free credit card? Yes, these are credit cards with the longest interest-free periods for purchases and also for balance transfers. These cards are accepted everywhere even allowing you to earn points or cash on your purchases. And just like any other credit card, watch out for transfer fees, late payment penalties, and other hidden fees.

Interested in getting no interest credit cards for 24 months? Let us give you a head start with the top ten best in the market today.

10 Best 24 Month Interest Free Credit Card Providers

1. Chase Freedom Credit Cards 24-Month Interest-Free

Chase Freedom comes in Unlimited, Flex, and Student, with all cards allowing you to earn cash back with your purchases. You can use these cards everywhere and earn as you use them.

Freedom Unlimited has the best reviews as it comes with the best features. This credit card lets you earn 5% cashback when you use it for travel, 3% when you use the card to dine out and take out food, and 1.5% on all other purchases.

You’ll feel confident with its 0% intro APR up to 15 months from the time the account was opened. After the introductory period, APR of 14.99 to 23.74%. You’ll get absolutely no annual fee.

If you’re new to Chase Freedom, you will receive a $200 bonus together with a 5% cashback on groceries. This is when you spend $500 in the first three months when you open your account.

Meanwhile, the Chase Freedom Flex offers similar perks to the Unlimited but gives you 5% cash back for up to $1,500 in total purchases in different categories for every quarter you use the card. Just like the Unlimited, expect no annual fees and extended interest-free use.

Finally, the Chase Freedom Student card offers 1% cashback on all your purchases. With this card, you can earn as you build a good credit standing. APR is 14.99% variable with zero annual fees. And as a new cardmember, Student users get a $50 bonus when the first purchase is made during the first three months from the time the account was opened.

Good points to remember about the Chase Freedom credit cards

- Unlimited and Flex offers 0% introductory APR for 15 months from the opening of the account. APR adjusted to 14.99 to 23.74% after.

- There are no annual fees for all cards.

- You can earn cashback when you spend with your card. Use it for dining, takeouts, drug store purchases, and travel.

- Get bonus cash offers when you spend with your card within the three months from the time the account was opened.

2. Citi Diamond Preferred Card 24-Month Interest-Free

Not only will you get low intro rates but 0% introductory APR for 18 months with the Citi Diamond Preferred Card. This goes for all purchases and balance transfers.

After the intro period is over, your APR will be adjusted to 14.74 to 24.74% and is according to your creditworthiness. In other words, you may be charged for as low as 14.74% if you pay for your purchases on time.

Citi Diamond Preferred Card has perks that you need and enhanced protection on your account as well. Your card gives you access to your FICO score in an instant without any effects on your credit score. You can monitor your score as much as you like anytime.

You also get full access to Citi Entertainment where you can purchase tickets to events such as concerts, live shows, sporting events, and many more. With Purchase Protection, your account is backed with $0 Liability on any unauthorized purchases. You’re covered with the Citi Identity Theft Solutions to protect yourself as you shop online or offline.

It’s easy to apply for a Citi Diamond Preferred Card. All you need to do is to go online and shop at Citicards.citi.com to fill out an application and to get approved.

Some great things about the Citi Diamond Preferred Card

- Get the lowest 0% APR for 18 months. This covers all your purchases and even balance transfers. APR will be 14.74 to 24.74%; rates depend on your creditworthiness.

- This card has no annual fees.

- Get FREE, exclusive, unlimited access to your FICO score without affecting your credit score/credit standing.

- Get access to Citi Entertainment for exclusive perks and rates for entertainment tickets.

- Protect your identity when you shop with Purchase Protection.

- Application is easy and everything is done online

3. ANZ Low Rate 24 Month Interest Free Credit Card

ANZ Low Rate credit card does not just offer low rates but zero percent interest for 25 months for balance transfers. This is a good 0 APR credit card for 24 months to consider. This exclusive offer will revert to standard balance transfer rates after the 25 months special offer period. Standard annual fees will apply for the succeeding years.

ANZ Low Rate will let you enjoy 12.49% pa on purchases; this is the lowest rate offered by ANZ. Use this with Apple Pay and Google Pay to purchase items online and other digital goods. This card helps you shop safely with special user protection features like ANZ Falcon and the ANZ Fraud Money Back Guarantee.

ANZ Low Rate is designed for Australian residents. These could be permanent or non-permanent residents as long as you have more than 9 months left in your visa. Applicants must have good credit standing and must present important documents handy in the time of application.

Just like all ANZ cards, the Low Rate also lets you use the ANZ App Plus so you can tap and pay with your ANZ credit card. Use this card to tap and pay for any purchase that’s below $100 through ANZ Visa payWave. With this feature, there’s no need to enter your PIN, swipe, or dip your card.

Some great points of the ANZ Low Rate credit card

- With a 0% annual fee during the first year. Annual fee returns to $58 after the introductory period.

- Get low-interest rates on your purchases at only b12.49 pa.

- Use the Low Rate with Apple Pay or Google Pay.

- Secure your identity when you shop online or offline with ANZ Falcon and the ANZ Fraud Money Back Guarantee.

- Takes only minutes to apply.

- For Australian permanent and non-permanent residents (non-permanent residents must have more than nine months in their visa).

- Good credit standing is considered for this 24-month interest-free credit card.

4. Skye MasterCard 24-Month Interest Free

Another credit card that lets you enjoy zero interest on balance transfers for 25 months is the Skye MasterCard. This is a limited offer 24 months no interest card and will expire on October 2020 so if you’re interested, you better apply now!

Skye MasterCard will let you enjoy 110 days interest-free on your purchases. Use this card to convert your large purchases to a period of 9, 12, or up to 15 months without paying any interest; only pay a very minimal one-time fee. You won’t be charged any foreign transaction fees even when you shop online at international sites.

You will be charged a $99 annual fee but it’s a small price to pay for zero interest rates, zero rates on repayment plans, and zero rates on repayment for 60 months when you shop from Skye’s selected trusted retail shops.

Application for a Skye MasterCard is easy. You must be an Australian resident with good credit standing and must present important documents like an Australian driver’s license or passport, proof of income, and your mobile phone number and email address.

Some great reasons why Skye MasterCard is for you

- Get zero interest rates on balance transfers for up to 25 months – this is a limited-time offer.

- Get up to 110 days of free interest on purchases.

- You can convert any large purchase to interest-free installments for 9, 12, or up to 15 months. Pay only a minimal fee.

- Shop online to any site from anywhere without paying any foreign transaction fees.

- Pay only a $99 annual fee and enjoy all the zero percent perks.

- This 0 credit cards for 24 months is for Australian permanent residents only with a good credit standing

5. Discover Cash Back Credit Card 24-Month Interest Free

With a Discover Cash Back Credit Card, you will earn cashback and Discover will match your earnings on your first year. And the best part is, you’ll get zero introductory APR for 14 months and only 3% introductory balance transfer fees for a limited time until December 10, 2020. Afterward, standard APR will apply at 11.99 to 22.99% with up to 5% fee for succeeding balance transfers.

Discover is different as it lets you earn more. You will get 5% cashback on all your daily purchases no matter where you shop like grocery stores, gas stations, and online through Amazon or PayPal.

You will also automatically earn 1% cashback on all your other purchases. Get unlimited $ for $ match of cashback that you have earned during the first year of use through the Cashback Match feature.

Cashback offers through Discover vary depending on the quarter. For example, the first quarter of 2020 lets Discover card users get cash back when they shopped at grocery stores, CVS and Walgreens, in the second quarter of 2020, card users enjoyed cash back from gas stations, Lyft, Uber, and other wholesale shops. In the third quarter of 2020, restaurants and PayPal users received 5% cashback and in the coming fourth quarter, card users can enjoy a cashback bonus when they use their Discover card as they shop at Amazon.com, Target.com, and Walmart.com.

The cashback points never expire and you can use this in different ways. You can deposit your cashback to your bank account, apply this to your Discover card balance or use these to pay for your PayPal or Amazon payments at checkout.

Other perks of going with Discover include free Social Security Number alerts, account on or off, and zero $ fraud liability. All these to safeguard your account no matter where you shop. You also get free FICO Credit Score checks (without affecting your credit score), free overnight shipping for a lost card, and 24/7 U.S. customer service support.

Some great things to consider when using the Discover Cash Back Credit Card

- Discover will match your cash back earned on your first year of use using Cashback Match.

- With no annual fees whatsoever for a year

- Low introductory APR at 0% for 14 months on balance transfers and purchases.

- Get 5% cashback on different purchases from different establishments online and offline.

- Get 1% automatically on other purchases

- Cashback will not expire and you can deposit this to your bank account, use it as a credit card balance or use this to pay for Amazon.com or PayPal.

- With outstanding security features and customer support.

- With free FICO credit score checks and overnight shipment for a lost card.

6. Bank of America Cash Rewards Offer 24-Month Interest Free

The Bank of America Cash Rewards credit card offers higher cashback in any category you want to shop. You can select from categories like gas, dining, drug stores, online shopping sites, and home improvement or furniture.

Get a $200 bonus offer applied to online rewards and 3% on cashback for any category that you selected. You can use a convenient rewards calculator tool found on the Bank of America site to calculate your rewards for categories. You can change your category through the Bank of America app or online site every month for all your future purchases.

Get 0% introductory APR on your first 12 months of purchases from the time of opening the account. Afterward, a variable APR of 13.99 to 23.99% applies. If you’re a Preferred Rewards member, you can earn more cashback on all your purchases. From 3% on every category, you can get as much as 5.25%, grocery and wholesale clubs can increase up to 3.5%, and other purchases from 1% to 1.75% for the 1st $2,500 in any combined category purchases for every quarter.

With the Bank of America card, you’ll stay protected from fraud or any fraudulent activity with their 0$ Liability Guarantee. Your card comes with a contactless chip so you don’t need to enter a PIN, swipe, or dip your card. Just tap to pay.

You can add the Bank of America credit card to your Apple Pay, Samsung Pay, or Google Pay account to shop online or in-store. Other perks include account alerts, paperless statements, and unlimited access to your FICO Score.

Great reasons why the Bank of America Cash Rewards credit card is for you

- Receive a $200 cash rewards bonus up to 90 days of account opening or when you activate your card

- Get 3% cashback on your selected category; you can change categories every month.

- You can use this credit card online or in-store purchases and still earn cashback.

- Enjoy zero annual fees

- With very low intro APR after 12 billing cycles variable APR is 13.99 to 23.99% currently.

- Stay protected with fraud protection and zero liability guarantee features.

- With the contactless chip feature, no more PINs, dips, or swipes.

- Use your Bank of America card with Apple Pay, Samsung Pay, or Google Pay.

- With free unlimited FICO score checks

7. American Express Cash Magnet 24 Month Interest-Free Card

The American Express Cash Magnet Card lets you earn up to $300 on cashback. Get 10% back or up to $150 when you use your card in supermarkets in the U.S. during the first six months of membership. Earn $150 more when you use $1,000 on purchases during the first six months. Cashback will be returned as statement credits.

Enjoy 0% APR for 15 months from the date you opened your account. Afterward, you will get 13.99 to 23.99% APR. You’ll get ultimate payment flexibility as you have an option to carry a balance with interest or pay the amount in full for every month. You will continue to earn cash back or rewards. You have the choice of where to use your American Express card in places that you want to shop. Just use the AMEX app to add offers and use the card to pay or enjoy rewards.

Enjoy using your American Express Cash Magnet card as AMEX is the most widely-accepted credit card in the U.S. Application for a Cash Magnet credit card is done completely online and you’ll know if you’re approved or not in just 30 seconds.

Reasons why the American Express Cash Magnet card is for you

- Get up to $300 on cashback when you use the card in your first six months of membership.

- Cashback is returned to your account in statement credits so you can use it again to shop.

- Enjoy 0% APR up to 15 months from the date you opened your account for all purchases. Succeeding variable APR of 13.99 to 23.99% applies.

- Enjoy payment flexibility whether paying for small or big purchases online or in-store.

- You can choose the category where you want to receive rewards. Choose from the places that you want to shop like restaurants, groceries, travel, leisure, and more.

- Application for an American Express Cash Magnet card is quick and easy in just 30 seconds. Everything is done online.

8. Capital One Quicksilver 24 Month Interest-Free Credit Card

Claim your $150 cash bonus for new members when you open a Capital One Quicksilver credit card. You will also earn 1.5% unlimited cash back for any purchase anytime, any day.

The $150 cash bonus offer is for spending $500 on any purchase within the first 3 months of opening your account. You won’t be charged any annual fees.

With the Quicksilver card, enjoy rewards at Amazon.com. It is the most convenient shopping site where you can find millions of products all over the world. Use your card for Premium Experiences giving you more than 1.5% cashback for entertainment tickets, dining and club tickets, and many more.

Quicksilver offers 0% APR for the first 15 months and 15.49 to 25.49% variable APR in succeeding months. No transfer fees, no foreign transaction fees (even in online purchases), and rewards and cashback that will never expire.

You can use your Capital One Quicksilver cashback as cash. Capital One can send you a check or apply this amount to your statement credit. Use your cashback to buy gift cards or to cover your purchases.

There are plenty more perks for all Capital One cards. Check these out when you apply for a Quicksilver which only takes a few minutes.

Great reasons why Capital One Quicksilver is your credit card

- Enjoy your new member gift of a $150 cash bonus when you spend $500 during the first three months of your account opening.

- Enjoy no annual fees

- Get unlimited cash back 1.5% on all your purchases.

- Use this card’s rewards to shop at Amazon.com and to enjoy Premium Experiences.

- No foreign transaction fees, minimal transfer fees, and zero APR for 15 months.

- Rewards will never expire as long as you use the account.

- You can use your cash back rewards to pay for purchases, buy gift cards, or as cash as a statement credit.

9. Bank of America Travel Rewards 24-Month Interest-Free

Receive up to 25,000 online bonus points and zero annual fees with a Bank of America Travel Rewards credit card. This is your card to enjoy travel points as you earn unlimited 1.5 points when you spend on any purchases everywhere at any time.

Your cash back rewards will never expire and you can calculate your rewards using an easy rewards calculator tool at the Bank of America site.

You will receive a contact-less card with no need to input your PIN, swipe, or dip in a machine. Just tap and you’re ready to go. You can use this card whenever you book a trip with no blackout dates. You can reward yourself with statement credit that you can use for your future travel expenses.

You will have 0% intro APR for 12 months or billing cycles for all your purchases. Afterward, you will have a variable APR set currently at 14.99 to 22.99%. If you’re a Preferred Rewards member, you can earn 25 to 75% more points for your purchases. You can enroll as a Preferred Rewards member also at the Bank of America website.

This travel credit card has no annual fees and zero foreign transaction fees. You can earn points and enjoy zero fees when you pay for hotels, flights, cruises, Air BNBs, rental cars, vacation packages, and baggage fees. You can also collect more perks and rewards every time you spend.

With the Bank of America Travel credit card, you’ll stay protected from fraud with their 0$ Liability Guarantee. You can add the Bank of America Travel credit card to your Apple Pay, Samsung Pay, or Google Pay account to shop online or in-store. Enjoy other perks like account alerts, paperless statements, and unlimited access to your FICO Score.

Why Bank of America Travel credit card is for you

- If you love to travel when this is for you. If you’re a business traveler then this travel card should be your card of choice.

- Enjoy 2500 online bonus points with no annual fees.

- Get 1.5 points for every dollar you spend on anything, anywhere, and anytime you shop.

- Get a low APR of 0% for 12 billing cycles for all your purchases. Low APR follows after.

- With fraud protection and zero liability guarantee.

- With the contactless chip feature, no more PINs, dips, or swipes. Just tap on the machine to pay.

- Use your Bank of America Travel credit card with Apple Pay, Samsung Pay, or Google Pay.

- With free unlimited FICO score checks anytime without affecting your credit score.

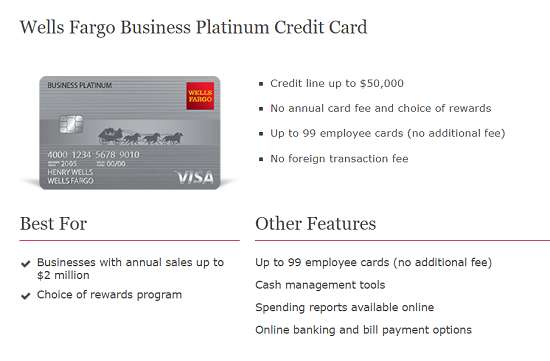

10. Wells Fargo Platinum 24 Month Interest-Free Card

The Platinum Card from Wells Fargo has the lowest intro APR for 18 months. This is close enough to zero interest credit cards for 24 months. Enjoy this from the time you opened your account with no annual fees.

This card is protected with Zero Liability for fraud and unauthorized transactions, transaction alerts, and mobile phone protection. You will also get unlimited access to your FICO score no matter where you are using the Wells Fargo app.

Get 0% intro APR for 18 months and after this period 16.49 to 24.49%, APR applies. The rate depends on your creditworthiness. You also get 0% APR on balance transfers for 18 months after account opening.

Your Wells Fargo Platinum Card is great for auto owners and travelers as you can get auto rental collision perks, roadside dispatch, travel accident insurance, emergency travel assistance, and mobile phone protection. Every card is built with chip technology to enhance protection and contactless payment in stores.

Why the Wells Fargo Platinum Card is for you

- Get the lowest APR intro for 18 months

- 0% APR on balance transfers for 18 months

- Enjoy no annual fees

- Fool-proof account protection with Zero Liability and transaction alerts

- Free FICO credit score access through the Wells Fargo online app

- With travel and driver protection features

Final Verdict

Found your 24-month interest-free credit card yet? Please take note that APRs and rates change as terms and conditions for every credit card change over time. Consider all the features of a credit card, especially security features so you can confidently and safely shop anywhere online and in stores. Also, consult the best mortgage lenders for first-time buyers if you want to purchase a home through credit.